Bank by name, Sainsbury's by nature

Δ 10% of consumers could achieve this saving in their first year with Lifetime £5,000 Pet Insurance. Based on online independent research by Consumer Intelligence. January 2024 to March 2024.

Discover our latest product offers

Travel money rate sale

Travel money rate sale on now

Ends 9:30am on Thursday 2 May 2024. Online and phone orders only.

Not available on sterling, travel money card home delivery orders and reloads or foreign currency bought instore.

Home Insurance

Savings to sing about. Choose the level of cover to suit you.

ˣ 10% of consumers could achieve this saving in their first year with Sainsbury's Bank Buildings & Contents Insurance. Based on online independent research by Consumer Intelligence. October 2023 to December 2023.

Loans

Find out how likely you are to be accepted without affecting your credit score.

From 6.0% APR representative for Nectar members when you borrow £7,500 - £15,000 for 1-5 years. T&Cs apply. Credit subject to status.

Life Insurance

Get up to 22,000 Nectar points when you buy life insurance.

Points are awarded in relation to the cost of your premium. Only choose a premium you can afford and the level of cover you require.

Provided by Legal & General

Financial Services Compensation Scheme

All of our savings products are covered by the Financial Services Compensation Scheme (FSCS). For further information about the compensation provided by the FSCS visit www.fscs.org.uk

Protecting your money - A guide from the FSCS [PDF, 557Kb]

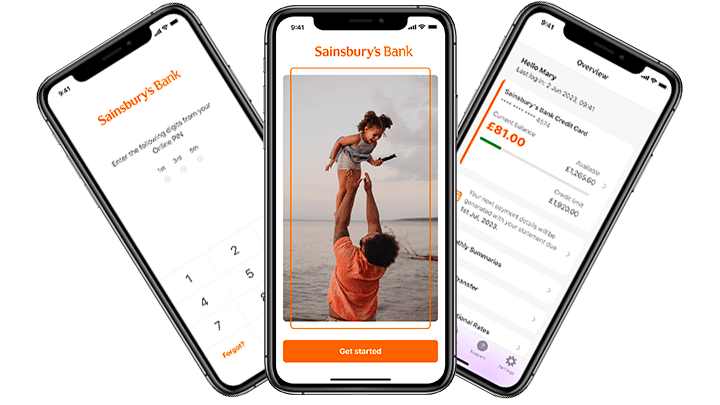

Download our handy credit card app

Credit cards made simple with the Sainsbury's Bank Credit Card App

Check your balance while you are out and about and manage payments on the go.

If you’re a Sainsbury's Bank credit card customer, register for online banking and download the Sainsbury’s Bank Credit Card App from the Apple App Store or Google Play Store

to gain easy access to your account.

Apple, the Apple logo, iPhone, and iPad are trademarks of Apple Inc., registered in the U.S. and other countries and regions. App Store is a service mark of Apple Inc. Google Play and the Google Play logo are trademarks of Google LLC.

Helping with the cost of living

See how we could save you money by checking out our handy hints and tips on how to cope with living costs on our cost of living hub.

We've answered a number of questions that may help put your mind at ease in our cost of living frequently asked questions.

Help when you need it most, with even better deals for Nectar members.

Bank by name, Sainsbury's by nature.

.jpg)